What I learned from mapping business processes for a major bank

Written by Tomislav Rozman

17 May 2022 · 9 min read

When a major international bank hired me to help them map their business processes, I had a flashback to my own experience of the mortgage loan process.

My first-hand experience was a valuable starting point for our process modeling sessions. We could avoid typical analysis-paralysis arising from focusing on internal processes that neglects customer needs.

I remembered how painful it was to navigate the loan process as a customer. I was looking for a bank loan and I was in a hurry to buy a house and relocate my family. I wasn’t their typical client, and the experience of loan processing was a nightmare. I visited nine banks in my hometown without success. I was worried and frustrated. How long would it take to approve the loan? Would I even get it? What steps did I need to take?

There was no clear communication. I never received a single email from any of the nine banks. I started to think, “If logistics companies like Amazon or AliExpress can send me a notification for each stage of my parcel’s journey, why can’t banks?”

But then, at the 10th bank, I met a very capable employee who made the customer experience better. The customer journey still wasn’t transparent, but she improved the whole experience.

How did the story end? Read on.

Process models shouldn’t be boring, messy and in greyscale

Fast forward several years. I was working as a consultant for an international bank. The bank had recognized the need to implement a business process management (BPM) approach, and needed to document and model their processes if they wanted to prosper. They hired me to show them how to capture those processes.

I taught them how to use BPMN (Business Process Modeling and Notation) – a common business language which has become an industry and ISO standard over the last 20 years. The bank in question is still successful and is expanding its business to new countries. I’m sure this is in no small part due to their revised vision and process orientation.

I’ve seen the same story many times. All the companies I’ve consulted for have shown clear dedication to process-driven management. They have made the important decision to model and document their processes, then improve them as the first step towards digitalization. And every company is successful, with a competitive advantage.

Nevertheless, during my consulting jobs (with banks, public admin, IT companies and more), I’ve noticed several pain points with the process modeling tools. They used to be clunky, slow and for a single user only with no collaboration functionality.

Almost all the process modeling tools nowadays support BPMN.

In addition, apart from BPMN support, what a process analyst needs is:

- User-friendliness and ease of use. You don’t have time for a long learning curve. You need to start modeling fast – in a matter of minutes, not days.

- Speed. When you model processes in a focus group with customer representatives, you don’t want a tool that lags. You want responsiveness and quick access to modeling elements and process shapes.

- Collaboration and sharing. Process modeling can be a lonely task, but it is far more efficient if done within the team, concurrently and stored in a central repository.

- Visual styling. The BPMN technique is great, but it doesn’t cover all the quirks and peculiarities of real life. Most people are visual learners. Greyscale process models are boring and unappealing. When an analyst shows the process to co-workers and non-analysts, it should catch their eye through color and a neat layout.

Process modeling tools have quickly evolved in the last few years, from single-user Visio plugins to cloud-based, collaborative, repository-based tools.

I’ve tested many BPMN tools in my career and recently came across the Cardanit BPM software.

Without hesitation, I can say the Cardanit BPMN editor is one of my favourite process modeling tools. Not only does it cover all the desirable features mentioned above, it also goes a step further.

Let’s look at how it can be used to map a customer journey and experience.

Focus on the customer EXPERIENCE, not only the customer journey

Here’s the appeal for business analysts, especially bank analysts.

When you’re modeling processes, focus on the client’s point of view. I know it’s tempting to model internal processes (what you do in the bank itself). It’s because you know them best. But you must resist it.

Put yourself in the shoes of a customer and model their interactions with your bank. Leave the inner working of your organization to one side for now. Even better, run a focus group session and model the process with clients. They should tell you the ideal customer journey.

Your goal is to transform your bank into a client-centered organization. Client-centred, not self-centered. You adapt to the customer, not vice versa.

BPMN is a technique that allows you to create (sometimes dull and complex) process models. But you want more. You want colorful, accessible, easy-to-read process models.

When you are designing process models to be ‘consumed’ by other users (not only machines), you need to apply style.

You also need to create a process architecture – a ‘forest’ of hierarchically and otherwise related process models.

Let me show you how.

Cardanit BPMN editor excels at the easy creation of process models with the above-mentioned features.

Step 1: Create a high-level process diagram of the customer journey process

How does the customer journey process modeling differ from general process modeling?

Firstly, you should focus on the client. Design a high-level, ‘parent’ process, for example, a process that encompasses the whole journey of a customer who wants a loan. Capture three to five main phases.

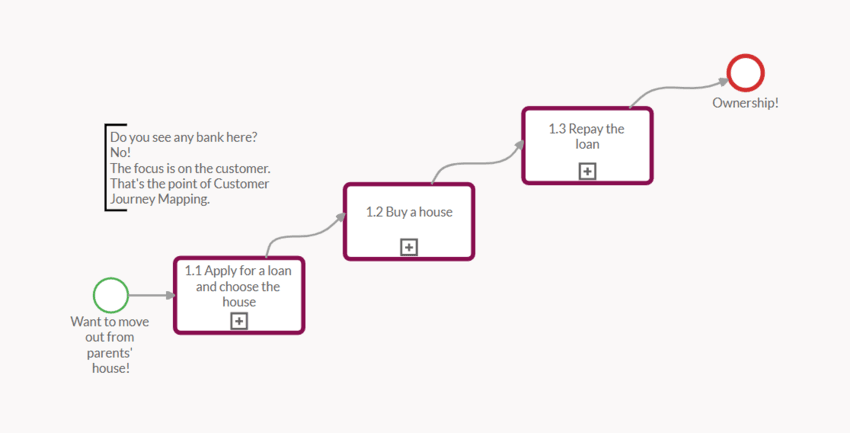

In the example below, we divided the customer journey process into three main subprocesses:

- Apply for a loan

- Buy a house

- Pay back the loan

Why these three in particular? Because they’re separated by major milestones or happy moments in a client’s life: the loan is approved, the house is bought and the loan is paid back.

We added the main trigger (what starts the process): a strong need to move out of their parents’ house.

Why are we so specific here? There are probably other reasons for getting a loan. But we are targeting a particular user group and trying to adapt the process for them.

Firstly, specialize the process, then generalize.

We used a ‘Call activity’ BPMN element here for two reasons:

- It visually represents (+ symbol) that the details are hidden

- It acts like a go-to statement (Go and read the details of this subprocess elsewhere)

Figure 1. High-level ‘Bank loan’ UX process

Step 2: Deep dive into the customer journey process

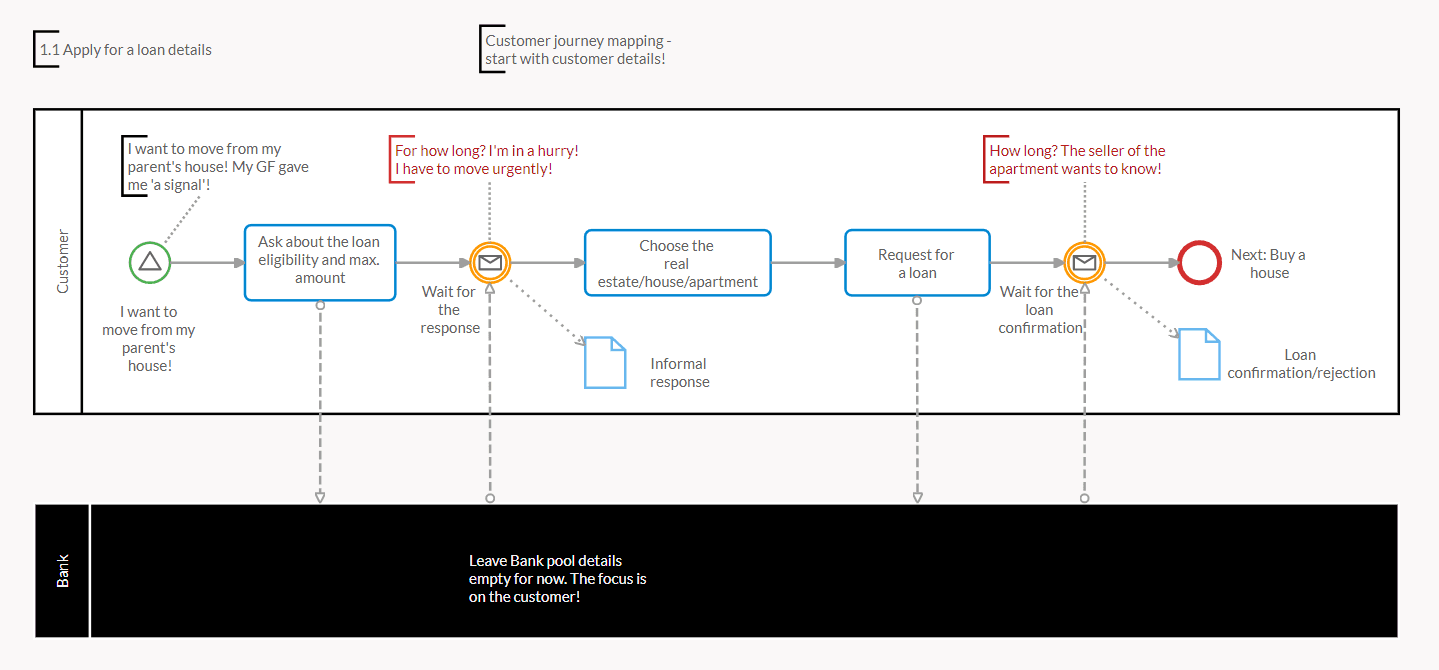

Now that we have captured the big picture, let’s deep dive into the details of the process. We’ll create a new process model that contains the details of the ‘Apply for a loan’ process. We’ll add details like:

- roles (who does what)

- activities (the steps in the customer journey)

- events (showstoppers, pauses)

- message flows (communication)

- data objects (documents)

- gateways (alternative routes in the process)

The bank pool and related client onboarding process stay empty (for now).

We call the empty pool a ‘black box’. A black box means we are currently not interested in the internal working of the bank pool, we only want to know the interfaces to it. Interfaces to a black box are usually modeled as input and output messages, such as ‘Loan request’, ‘Informal response about loan eligibility’ and ‘Formal loan confirmation’ in our case.

With Cardanit BPMN editor, you can literally make the pool look like a black box.

Should a customer know about all the inner bank peculiarities like credit score calculation, real-estate evaluation and multi-level confirmation of the loan? Yes, but not yet.

Step 3: From customer journey to customer experience

BPMN process modeling tools are useful for customer journey modeling. For customer experience modeling, less so.

Using Cardanit BPMN editor, we can enhance the process model with customer experience details.

How does a ‘customer experience’ differ from a ‘customer journey’?

When modeling CX (Customer eXperience), we also focus on:

- Customer touchpoints with our organization

- Customer pain points

- Customer positive engagement

- Customer expectations

Let’s look at our process model and how these can be represented:

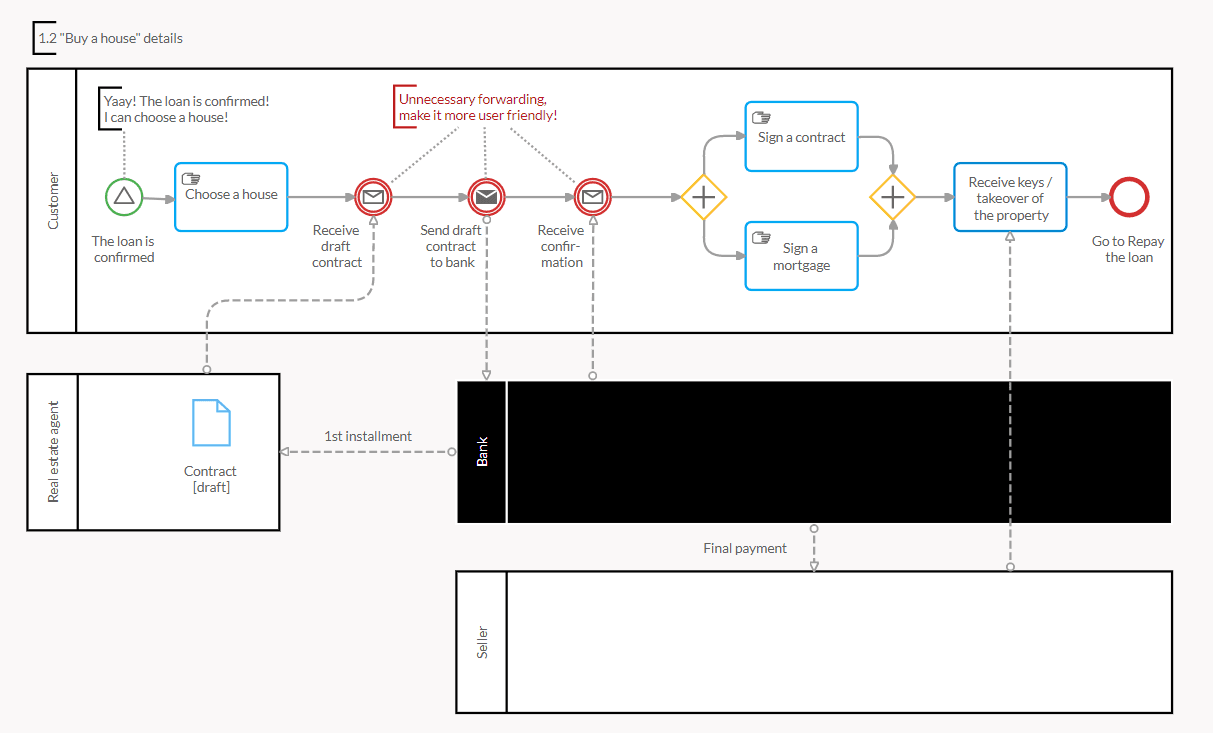

Figure 3. ‘Buy a house’ subprocess

CX specifics in this process model:

- Touchpoints are modeled with BPMN message flows and message send/receive events

- Pain points are marked in red with additional comments (see ‘Unnecessary forwarding’). These are potential process improvement tips. For example, the unnecessary step of a customer forwarding a draft contract between a bank and an estate agent could be replaced with direct communication between these two parties.

- Positive engagement at touchpoints can be indicated with additional comments. The comment ‘Yaay, the loan is approved’ at the start event signals a customer’s positive experience with a bank. We could further detail this event/customer experience with a new bank subprocess called ‘Inform customer the loan is confirmed and send them a bottle of champagne.’

- Customer expectations can be represented with additional comments attached to events (see Figure 2): ‘How long should I wait for the confirmation? I'm in a hurry, I have to move urgently!’

All these tips result in a more useful process model and a solid basis for customer journey improvements.

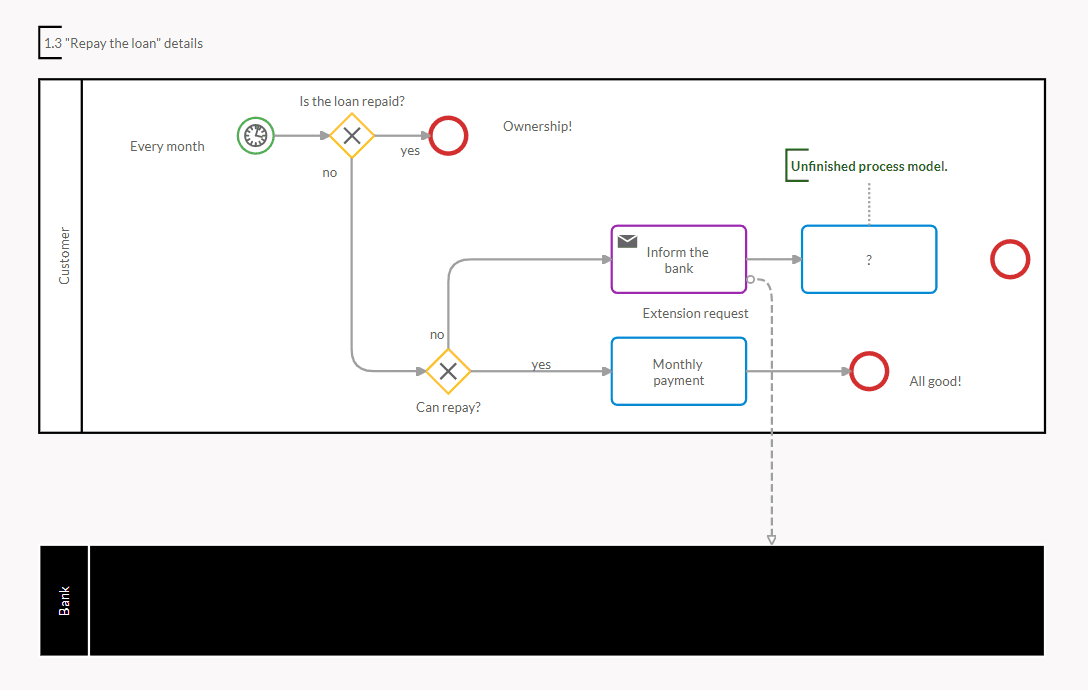

Following the previous logic, here is the last part of the process, which focuses on the client experience with the bank. ‘Repay the loan’ is one of the longest-running processes, typically spanning a decade or more. Life is unpredictable and a lot of things can affect the loan repayment.

If you’re a process analyst, have a go at brainstorming how to improve your customers’ experience with the bank during this lengthy part of the process. You can use Figure 4 as a starting point:

Step 4: Modeling the inner working of the client’s onboarding process

Remember the bank pool? Only when the BPMN diagram of a customer journey from the client’s point of view is finished, should you start to detail the bank pool.

For example:

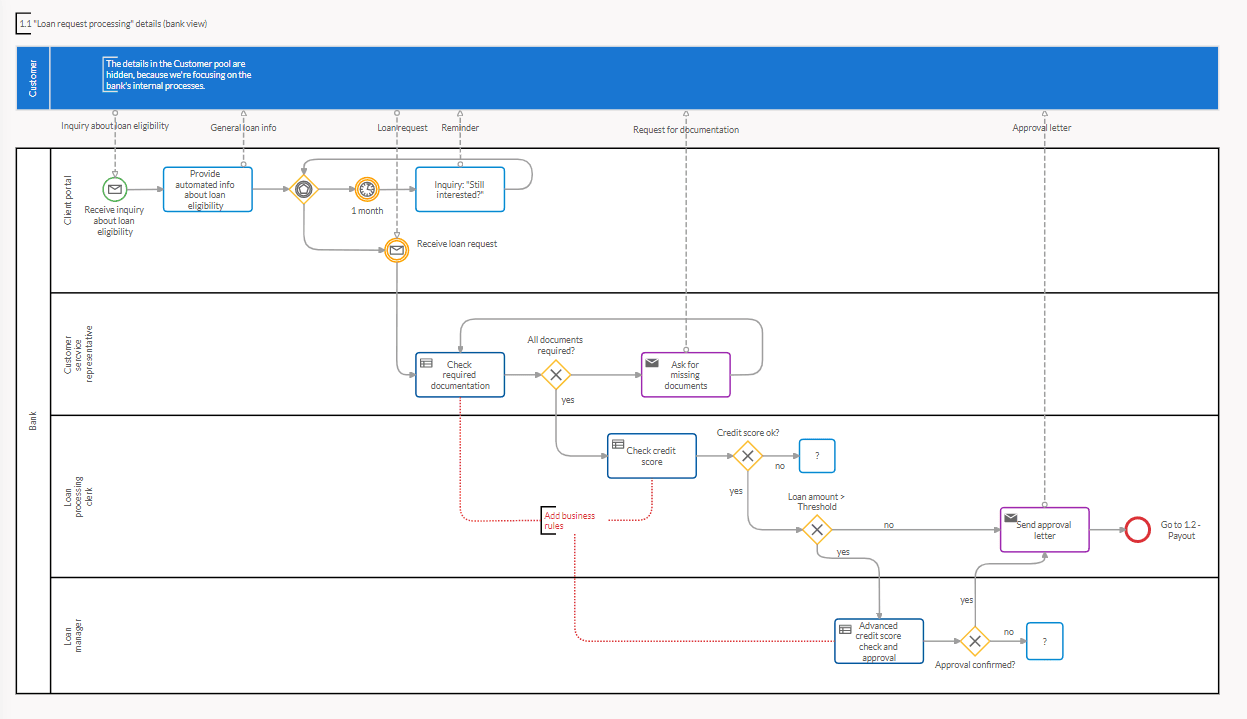

Figure 5. ‘Loan request processing’ (bank view)

In this process diagram, the details of the ‘Customer’ pool are hidden (see the blue box at the top), and the ‘Bank’ pool details are revealed. We kept the interfaces between pools (message flows) and are modeling the details of the inner banking processes related to loan processing.

While inner processes and roles (actors) differ from bank to bank, the general principles of loan processing apply.

As you will notice, only a positive scenario of the first subprocess is modeled (loan is approved). Exceptions (e.g. what happens if the customer’s credit score is too low) are not explored here. I’ll leave brainstorming about those exceptions and further design of the process diagram to you.

You don’t need to start modeling from scratch, you can simply reuse the ‘Bank loan’ template available in the Cardanit BPMN editor.

Summary – what I like about Cardanit BPMN editor

The three features of the Cardanit process editor that I like the best are:

Process diagram visibility

Process models should be easily accessible. Just like any tools in a workshop, they should be within reach. The business processes shouldn’t be buried in ISO documents in hard-to-reach intranet portals or via client apps with limited viewer licenses.

The process models should be available and searchable from anywhere, on any device.

Cardanit BPMN editor offers this as it is accessible via a web browser.

Process diagram sharing and collaborative work

A process model is rarely a one-person product. Process analysts usually collaborate with several people who provide input to the process modeling (process owners, process performers, managers).

What if all these people collaborated?

Cardanit BPMN editor offers exactly this kind of shared collaboration functionality.

Process diagram appealing design

I like the little things that make process modeling enjoyable. For example, colors in process models. Curved edges of the sequence and message flows. Snapping of process elements to the horizontal and vertical guidelines.

All these things are not an automatic part of a BPMN specification, but they make an analyst’s work easier and more pleasurable.

Conclusion

Are you wondering how my story with the bank loan ended?

I finally got a bank loan, bought a house and paid off the debt in half the allotted time.

If only the bank knew this in advance. If their processes had been more efficient, they would have correctly calculated my credit score and seized the business opportunity. They could have given me a loan for double the amount and earned at least twice as much from the interest.

In the end, it all boils down to better tools and methods used by bank analysts for improving processes. Use the BPMN - Bank Loan - template to improve yours.

Further reading

Quick guide: Key ingredients for efficient process mapping

Quin and Cardanit synergy: Digitizing business process with BPMN

Dr. Tomislav Rozman sees process models everywhere he goes. In 2007, he received his PhD in computer science and informatics with a dissertation on holistic organizational process modeling. He has designed processes, customer journeys, and internal workings in public administration, banks, information technology firms, service firms, electro-distribution firms, construction firms, and educational institutions. The Supreme Court of Slovenia's e-enforcement information system is based on processes he helped design. He is the creator of an ECQA-accredited course for business process managers that hundreds of students have taken.

Dr. Tomislav Rozman sees process models everywhere he goes. In 2007, he received his PhD in computer science and informatics with a dissertation on holistic organizational process modeling. He has designed processes, customer journeys, and internal workings in public administration, banks, information technology firms, service firms, electro-distribution firms, construction firms, and educational institutions. The Supreme Court of Slovenia's e-enforcement information system is based on processes he helped design. He is the creator of an ECQA-accredited course for business process managers that hundreds of students have taken.

Use it as a reference list of the most used elements in BPMN and DMN or as a guide on how to put those elements into practice.

Free BPMN and DMN cheat sheet

Use it as a reference list of the most used elements in BPMN and DMN or as a guide on how to put those elements into practice.

Free BPMN and DMN cheat sheet

Use it as a reference list of the most used elements in BPMN and DMN or as a guide on how to put those elements into practice.